The financial world is unforgiving. One wrong move, and the consequences can follow you for years. Most people would take that as a sign to stay away. But not Roux-Han Armand Basson from Namibia. “I had a Bitcoin investment that went wrong. That loss made me realise how little I knew about investing and motivated me to learn more about the field and its inner workings,” he says. That turning point brought him to North-West University’s Centre for Business Mathematics and Informatics (BMI).

Basson first joined its Quantitative Risk Management programme, accredited by the Professional Risk Manager International Association (PRMIA). NWU is the third university in the world, and the very first in Africa, to earn this recognition for the first two levels of the Professional Risk Manager (PRM) qualification. Seeking something more challenging, he switched to BMI’s Actuarial Science programme instead. “I believed it would provide me with the best possible mathematical and statistical foundation, which has since proven to be true,” he explains.

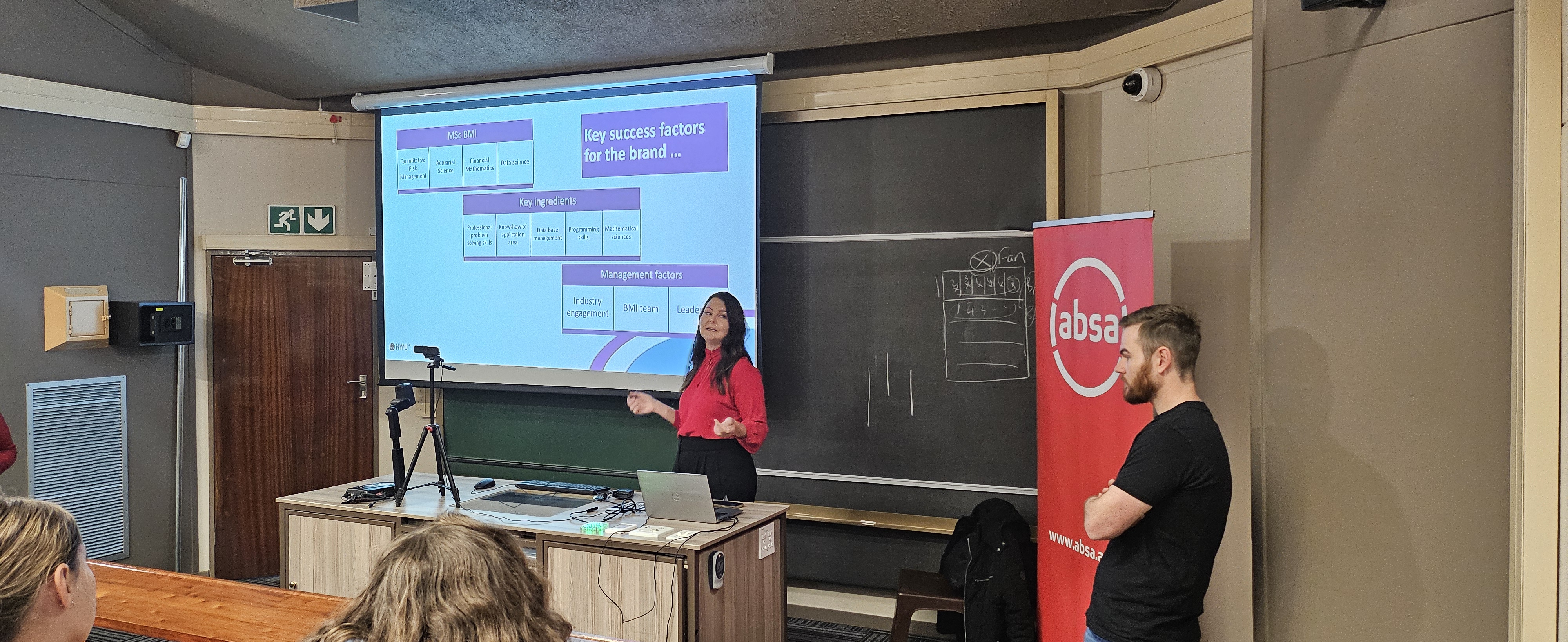

BMI is a leading tertiary risk training and research group for the finance industry. Your studies here are grounded in maths, economics, and information sciences. Source: North-West University

The BMI advantage

Founded in 1998 with ABSA Bank Limited, NWU’s BMI centre has evolved into the go-to source of talent for South Africa’s banking industry, especially in risk management and business analytics. Whether you’re interested in actuarial science, business analytics/data mining/data science, financial mathematics, or quantitative risk management, this is where you build the skills that make an impact.

“My programme’s curriculum is well-structured and logical, with first-year modules establishing a crucial foundation for subsequent years,” says Basson. “I appreciate the inclusion of additional modules that broaden our knowledge and understanding, which enriches the overall learning experience and ensures the material is relevant. The actuarial modules, in particular, stand out for their exceptional presentation and high-quality content.”

This commitment to excellence is even recognised by the Actuarial Society of South Africa (ASSA).

What makes the programme even more exciting is its STEM approach. You will explore mathematics, computational sciences, artificial intelligence, machine learning, operations research, and finance – not just in theory, but how to apply them in real-world contexts too.

“Students gain hands-on experience in programming languages such as SAS, R, Python, and SQL, which are essential for managing and analysing complex data,” says Professor Helgard Raubenheimer, BMI Director. “Beyond coding, they are trained in problem-solving frameworks that prepare them to tackle messy, industry-scale challenges – moving beyond textbook formulas to practical solutions that create real impact.”

With that kind of preparation, Basson now feels ready to plan his next step: earning an Honours degree. Indeed, the opportunities for postgraduate students at BMI are great. “Master’s students join six-month industry projects, co-supervised by both academics and industry experts. These projects give students direct exposure to cutting-edge research, innovation, and problem-solving within the financial and business sectors, while building a strong professional network even before graduation,” says Professor Raubenheimer.

Basson’s biggest takeaway as a student was self-growth. He learned that true education shapes character and inspires hope. Source: North-West University

Learning that opens doors everywhere

Learning at BMI doesn’t stop at theory and hands-on experience. Otherwise, it wouldn’t be recognised as a globally recognised centre of excellence for finance.

What further sets the department apart is how it brings industry to the classroom through its extensive partner network. Leading organisations including ABSA Bank Limited, financial services provider FirstRand, and data analytics company SAS offer guest lectures, bursaries, and specialised skills workshops. Meanwhile, visiting scholars and international conferences provide exposure to global thought leaders.

Become a BMI graduate and you’re set to find success wherever you go. For one, you can go into research at BMI, which is both rewarding and impactful. “One example is BMI’s role in banking regulation support,” says Professor Raubenheimer. “The Centre actively assists the financial sector with model validation and regulatory interpretation services, ensuring compliance and strengthening the resilience of South Africa’s banking system.”

Achievements like these have put BMI on the global stage, earning prestigious awards such as the Sichel Medal in 2015 and 2023, the RGA Prize, and the Operational Risk Paper of the Year from Risk.net in 2016.

If you’re not interested in research, that’s okay; BMI graduates are highly sought after in banking and financial services, insurance and reinsurance, as well as consulting and analytics. “My experience of BMI graduates is that they compare favourably with the best graduates that we employ from universities in the UK,” says Ian Wilson, Head of Wholesale Credit Risk Measurement: Group Risk for Barclays, London.

What’s more, its ASSA- and PRMIA-accreditation means that you’re prepared to compete and succeed in actuarial science, risk, and analytics globally. “The Centre for BMI hits the sweet spot between academic excellence and practical business skills,” says Pravin Burra, (FASSA) Director Capital Markets at Deloitte & Touche. “Due to this mix, we find that BMI graduates are not only bright but hit the ground running.”

For more information, visit the North-West University or follow them on Facebook, Instagram, TikTok, LinkedIn, YouTube, and X