Picture this: you’re living in a new country for the first time — miles away from home.

On top of this, imagine juggling student loans, living expenses, and finding extra cash to travel and spend time with friends.

It all adds up — and they can quickly drain your bank account. Who knows what could happen when you’re not aware of the apps for budgeting?

“I’ve maxed out credit cards, overdrawn bank accounts, absolutely wrecked my credit score, signed leases to apartments I could barely afford, and at one point, worked three jobs but had no emergency savings,” shares Kelly Anne Smith, a senior consumer finance reporter for Forbes Advisor.

An emergency fund, in Smith’s case, would have helped her to cover an unexpected expenditure.

But creating a safe buffer or navigating the many apps for budgeting is easier said than done — so let’s get down to the basics.

The best apps for budgeting show you how you’re spending and how to keep track of them. Source: AFP

How would you know what are the best apps for budgeting?

The best apps for budgeting do one of two things: you’ll have an easier time managing your money, or you can even invest any extra cash in these apps.

Apps for budgeting are known for their convenience since you can download them on your phone and use them anywhere, anytime — so long as you are connected to the Internet.

Most budgeting apps have visuals to help you see and track your spending; it beats tracking your expenses manually, helps you save time, and reduces the stress of managing your finances while studying abroad.

Beyond this, there’s more towards the topic of money apart from learning what’s the best apps for budgeting in the market.

Smith advises on the following points:

- Be smart about your student loan refund

- A credit card can be useful, but use it wisely

- While some apps have made day-trading stocks easier, you should stay from “memestocks” (a social media craze that can drive big peaks and crashes in company shares)

- Pay attention to school-sponsored bank accounts

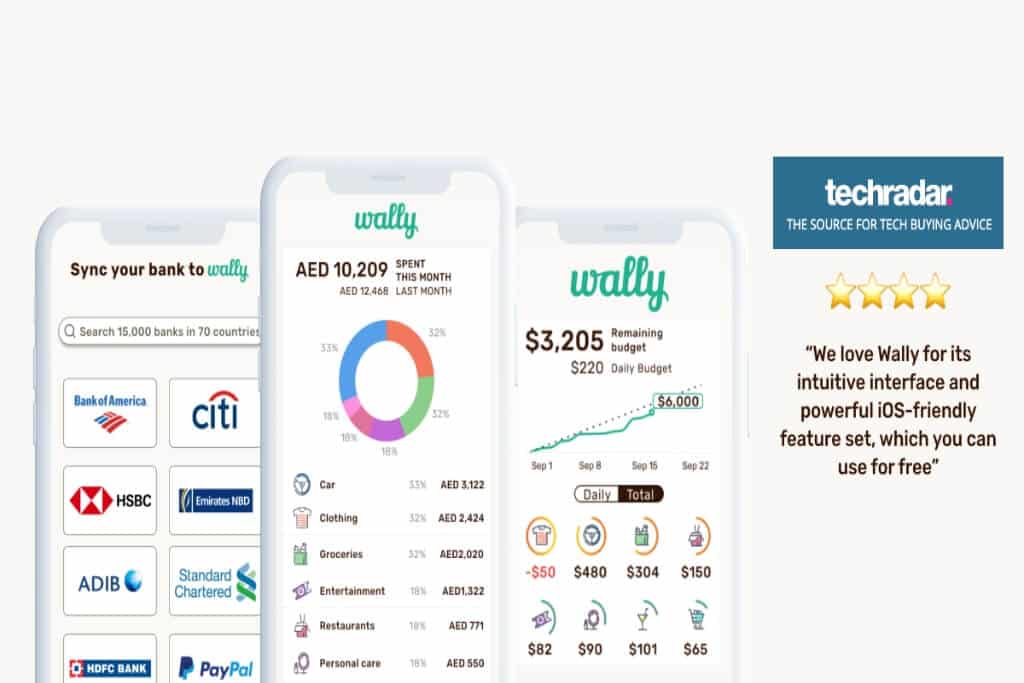

Wally is a budgeting tool and finance management app combined into one. Source: AFP

8 best apps for budgeting that are ideal for international students

1. Wally

- Cost: Free basic plan

- Available on iOS and Android

While you have to input your transactions manually, Wally still stands as one of the best apps for budgeting since it works with almost all foreign currencies.

Like most of the apps on our list, you can set and achieve your financial goals by tracking how you spend your money.

Wally also has its own AI chatbot called WallyGPT.

Built into the app, WallyGPT offers insights and guidance for any questions about financial terms, investment strategies and how to meet your financial goals.

So if you have a trip coming up and need tips on how much to save, you could ask the chatbot and receive a breakdown of average prices and how much to save for your trip.

2. Simple Budget

- Cost: Free

- Available on Android only

As the name suggests, Simple Budget makes it easy for you to manage your finances.

All you need to do is connect your bank account to create a budget for your monthly expenses.

Beyond this, you can automatically track your income and the amount of money you spend without signing in to two different apps.

The app also includes a feature that lets you know if you are staying within your budget or spending more than you should.

Chip is an automatic saving and investment app that provides access to market-leading interest rates and investment funds. Source: AFP

3. Chip

- Cost: Basic plan (free)

- Available on iOS and Android

When you connect Chip with your bank account, you can access features such as getting spending analyses, setting savings goals, and keeping track of saving progress.

Its inbuilt financial calendar helps you set payment reminders for your rent or student loans.

While the basic ChipLite Plan is free to use, the ChipX plan costs 5.99 pounds (US$7.59) per month.

A standout feature of in the premium plan includes free usage of Chip’s autosaving function, an AI tool that tracks your spending habits and bank balance to determine how much you can afford to save or invest.

Chip’s autosave function then automatically transfers small quantities of money regularly into the relevant accounts.

4. PocketGuard

- Basic plan (free), Premium subscription (US$7.99 a month, US$34.99 annually or US$79.99 for a lifetime)

- Available on iOS and Android

Similar to other apps on the list, you can track your spending by linking all your financial accounts.

From here on, all of your purchases will automatically upload — which comes in handy when you’re struggling to decide if you can afford that pair of sneakers or dress you’ve been wanting to get your hands on.

Within the app, you can establish savings goals to ensure you are on the right financial path to achieve your goals.

Its “In My Pocket” feature breaks down your monthly bills and organises them into categories to keep tabs on how much spending money you have available.

5. Splitwise

- Cost: Basic plan (free), Premium (US$3 a month)

- Available on iOS and Andriod

Do you struggle to split the bill when you’re eating out with your friends?

Or perhaps you’re looking for a way to track your grocery bills with a roommate.

Consider using Splitwise. It’s an app that allows you to track balances and other shared expenses so everyone pays their share.

The group feature helps you organise your expenses and your balance shows any outstanding payments.

Splitwise is also perfect for tracking who owes whom when you travel with friends. You can also record any cash or online payment so your friends know when you have paid.

While Splitwise is free, Splitwise Pro — which costs US$3 a month — allows you to scan receipts, save default splits and convert currencies.

6. Mint

- Cost: Basic plan (Free), Premium (US$4.99 a month)

- Available on iOS and Android

With more than four stars on the Apple and Google Play stores, Mint is arguably the best budgeting app for students.

You can create a budget based on categories, such as textbooks, vacations, meal expenses, and more. There’s even an option to set a limit for each category depending on how much you plan to spend.

Connecting Mint to your bank account will show you a spreadsheet that tracks your spending in each category.

When you go over your budget, Mint will send you an alert.

Mint Premium offers users an ad-free experience and specialised analytics that give a more detailed breakdown of your spending.

Goodbudget is a personal finance app perfect for budget planning, debt tracking, and money management. Source: AFP

7. Goodbudget

- Cost: Free for the basic plan

- Available on: iOS and Android

A list of the best apps for budgeting is not complete without Goodbudget.

This app is a digital take on the envelope budgeting system, an outdated method used to label a few envelopes with different spending categories and put a certain amount of cash into each.

Goodbudget uses the same idea, except you will save time and paper.

You can label your digital envelopes to indicate things you usually spend on — for example, school supplies, gas, fun money and food. Each category will have its own envelope.

When you sign up, you will be given 20 envelopes. However, if you need more, you must pay a subscription of US$8 a month or US$70 a year to get unlimited envelopes.

If you go over your budget, the app has a feature that will turn the envelope red to alert you.

What sets this app apart is that you don’t have to link it to your bank account — but that means inputting your transaction manually.

The app also has a debt tracker feature that allows you to see how much more money you will need to pay off your student debt and the progress you have made.

8. YNAB

- Cost: One year free trial for college students

- Available on iOS an Andriod

Did you know YNAB stands for You Need a Budget?

As the name suggests, you need to have a budget, especially as a uni student managing your tuition fees, rent and living expenses.

YNAB helps you do that by asking you to assign every dollar you plan to use.

Many users have noted that YNAB has helped them become more cautious of spending as the app highlights every dollar in their budget.

A few people noted that YNAB made them more cautious of spending since the app shines a spotlight on every dollar in their budget.

For those who like to use Excel spreadsheets to manage their finances, this app will make it easier to keep track of your money while still being detailed and precise.

All you have to do is connect your bank accounts and set goals for the amount you want to save.

It is also possible to make shared budgets, which you can use with your roommates to split shared bills.

YNAB costs US$14.99 a month, but they do have a free one-year trial for all college students.