Studying abroad is expensive — and the best budgeting apps can help you go a long way as an international student.

Much of this is true as you look at the average of studying in the US. You can expect to spend an average of up to US$18,000 on housing, food, textbooks, and many more per year.

What’s more, undergraduate tuition fees often range from US$3,800 to US$38,070, as reported by the College Board’s 2021 data.

Still, getting into the habit of saving at an early age lays the foundation for financial flexibility.

Having an emergency fund, for example, prepares for unexpected everyday costs, such as repairing a broken laptop.

How can the best apps for budgeting help?

Most budgeting apps are designed to help you easily manage your money.

Think of features that will track your expense or categorise your spending patterns. Some even have images to view your financial health.

Through personalised insights, these apps offer recommendations to save money, invest, and reduce debt.

The best budgeting apps help you track your money — what you earn and spend — so you’re in full control. These apps can link with your bank account and credit cards to automatically download transactions and categorise your spending that match your chosen budget.

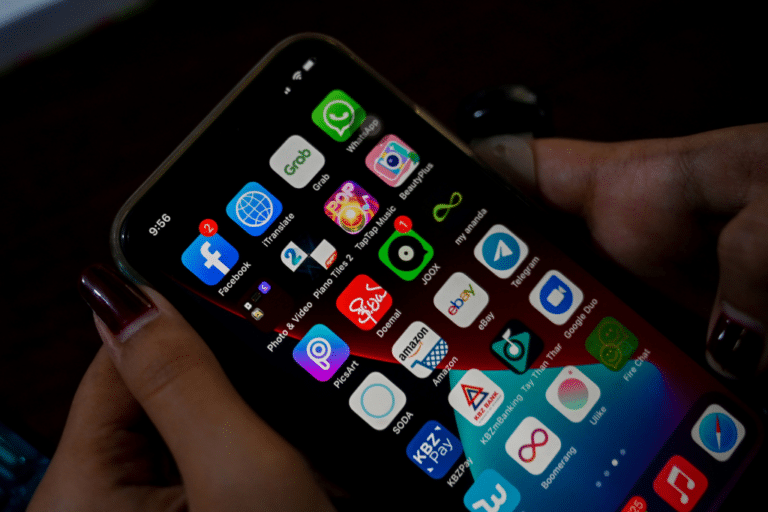

Most budgeting apps are affordable, user-friendly, and offer features that suit your budgeting approach. You can easily download these apps on your tablets and smartphones.

But how do you know which of these money-saving apps might work best for you?

It’s important to compare the features of each and learn more about what they offer before choosing one or more to use for money management.

That said, here are some top budgeting apps that can benefit international students:

Ready to get started on managing your money wisely? Consider these ten apps. Source: AFP

10 best apps for budgeting as a student

1. YNAB (You Need A Budget)

- Price: Annual plan is US$8.25 per month (US$99 paid annually), Monthly plan is $14.99 per month

- Free trial: Lasts 34 days

As one of the best apps for budgeting, YNAB is built on the principle of giving every dollar a job.

According to The New York Times, the app is “where you assign every dollar in your bank account to either a spending category or savings goal at the start of each month.”

With YNAB, you’re not just tracking your expenses; you’re actively deciding where your money should go.

Its proactive approach helps you break the cycle of living paycheck to paycheck and empowers you to allocate funds toward immediate needs, future savings, and even those aspirational dreams.

By providing clear insights into your financial landscape, YNAB equips you to make informed decisions, adapt to changes, and ultimately take control of your financial journey.

YNAB’s mobile app syncs with the desktop version in real-time, so you’re always updated on your financial situation.

2. Simplifi by Quicken

- Price: Currently, there is a 40% discount, so you only have to pay US$2.39 per month

- Free trial: 30 days

Simplifi by Quicken takes a comprehensive approach by integrating short-term spending decisions with long-term financial goals.

Named one of the best apps for budgeting for most people by The New York Times, this app’s robust features allow you to track expenses, create budgets, manage investments, and even plan for major life events like buying a home or starting a family.

By offering a holistic view of your financial landscape, Simplifi empowers you to make strategic choices that align with your aspirations.

With its ability to manage day-to-day finances alongside bigger financial objectives, Simplifi is a dynamic tool for anyone seeking a well-rounded financial plan.

It allows you to see how much spendable money you have after allocating funds for bills, goals, and necessities. Source: PocketGuard/Facebook

3. PocketGuard

- Price: Basic account is free and different PocketGuard Plus plans are available

- Free trial: Free version has no time limit

Simplicity is the hallmark of PocketGuard, making it an ideal choice for those who want a quick, no-nonsense overview of their finances.

The app’s intuitive interface categorises your expenses and calculates your “pocket,” which is the amount left after essential bills.

This instant clarity lets you identify opportunities to save and invest without getting bogged down in complex details.

You can also connect your bank accounts, credit cards, loans and investments, making it one of the best apps for budgeting because it is a one-stop-shop for all your money matters.

PocketGuard’s real-time tracking and alerts keep you updated on your financial health, ensuring you effortlessly stay on top of your budget.

4. EveryDollar

- Price: Free, premium version is US$17.99 per month or US$79.99 a year

- Free trial: 14 days

Claiming to be the simplest way to budget for your life, EveryDollar’s zero-based budgeting framework is said to be “simpler (and perhaps easier to manage) than YNAB“.

This app encourages you to allocate every dollar to a specific purpose, ensuring you know where your money goes.

With EveryDollar, you’re not just tracking expenses; you’re actively telling your money where to go.

This proactive approach empowers you to prioritise your financial goals, eliminate wasteful spending, and build a solid foundation for short-term stability and long-term wealth-building.

EveryDollar’s adherence to the zero-based philosophy makes it a powerful tool for anyone seeking to take control of their financial future.

Goodbudget uses a time-tested envelope budgeting method to keep you on track and manage money easier. Source: Goodbudget/Facebook

5. Goodbudget

- Price: Free, Plus version available for US$8 per month or US$70 annually

- Free trial: None available

Goodbudget’s tagline perfectly sums up its identity: Budget with purpose, spend, save, and give toward what’s important in life.

The app modernises envelope budgeting by providing a digital solution for allocating funds into virtual envelopes.

This approach ensures you know how much you have left in each spending category.

As one of the best apps for budgeting, Goodbudget is particularly useful for those who appreciate the tangible nature of budgeting with envelopes but desire the convenience of a digital platform.

By visually representing your available funds for different expenses, Goodbudget helps you prioritise and prevent overspending, making it an effective tool for achieving your financial goals.

6. Empower

- Price: Free

- Free trial: None available

Formerly Personal Capital, Empower transcends traditional budgeting apps by offering a comprehensive financial platform.

It seamlessly blends budget tracking with investment portfolio management, retirement planning, and net worth assessment.

An impressive 88% of over 18 million Empower customers would recommend someone they know to the app.

With Empower, you gain a holistic view of your financial journey, allowing you to make well-informed decisions that align with both your immediate needs and long-term aspirations.

Whether tracking daily expenses or strategising for retirement, Empower empowers you to achieve financial success by providing a single platform for managing your finances.

It shows that even as a student, you can make your money work for you.

With Mint, you can access all of your spending, trends, and budgets clearly in the “This Month” tab. Source: Mint/Facebook

7. Mint

- Price: Free

- Free trial: None available

Founded in 2006 with US$750,000 from angel investors, Mint has earned its reputation as a household name in budgeting by offering a comprehensive overview of your financial life.

The budgeting app gives a snapshot of your spending patterns and financial health.

Its bill tracking, credit score monitoring, and personalised budget suggestions guide you toward smarter financial decisions.

With its alerts and reminders, you can stay on top of bills, track your credit score, and work towards your financial goals.

What makes Mint one of the best apps for budgeting is its user-friendly interface and robust features.

8. Honeydue

- Price: Free

- Free trial: None available

Honeydue focuses on fostering financial transparency and collaboration within relationships.

This app connects partners’ accounts, enabling individuals to track their shared and individual expenses.

If one or both partners are studying, this app is a great way to help open conversations about finances and be a tool to manage and support your joint financial goals.

Honeydue is certainly one of the best apps for budgeting, as it makes it easier for you to work with your partner to achieve your goals together.

With features like bill reminders and expense categorisation, Honeydue fosters healthy financial communication, making it an essential tool for couples who want to strengthen their bond.

8. Fudget

- Price: Free, Fudget Plus available for US$19.99 per year

- Free trial: None available

Fudget stands out as a minimalist budgeting app that emphasises simplicity and flexibility.

With Fudget, you can create straightforward budgets for specific events, goals, or categories.

This app is perfect for those who prefer a clutter-free budgeting experience without the distractions of elaborate features.

By providing a basic yet effective platform for managing your finances, Fudget empowers you to stay organised and in control without needing extensive bells and whistles.

With Honeydue, you can seamlessly manage your money with your partner. Source: Honeydue/Facebook

9. Honeydue

- Price: Free

- Free trial: None available

Honeydue focuses on fostering financial transparency and collaboration within relationships.

This app connects partners’ accounts, enabling individuals to track their shared and individual expenses.

If one or both partners are studying, this app is a great way to help open conversations about finances and be a tool to manage and support your joint financial goals.

Honeydue is certainly one of the best apps for budgeting, as it makes it easier for you to work with your partner to achieve your goals together.

With features like bill reminders and expense categorisation, Honeydue fosters healthy financial communication, making it an essential tool for couples who want to strengthen their bond.

10. Stash

- Price: Stash Growth is US$3 per month, Stash+ is US$9 per month

- Free trial: One month

Stash marries budgeting with investing, suitable for those who want to make their money work harder for them.

This app introduces micro-investing, allowing you to start small and gradually build a diversified investment portfolio.

As you allocate funds to investments alongside managing your budget, Stash introduces you to the world of wealth-building through the power of compound interest.

With its user-friendly interface and educational resources, Stash is an excellent entry point for those looking to harness the potential of investing.