International students may be eligible for the second stimulus cheque if they meet certain requirements. The US$600 payment is part of a US$900 billion pandemic aid bill recently passed by Congress and follows the first aid package that provided relief money of up to US$1,200.

It depends if you are a qualifying resident alien or not. Citizens, permanent residents and residents for tax purposes can claim the next stimulus check under the CARES Act if they meet these requirements: have a valid Social Security Number (SSN) and have filed their 2018 or 2018 tax returns.

“It is our understanding that most international students, who are considered ‘nonresident aliens’ for tax purposes, are not eligible to receive this, but some might. If you meet the substantial presence test and are thus considered a resident alien for tax purposes (not the same as permanent resident with a green card) and have an SSN, it appears that you might receive it,” according to the University of Oklahoma’s website.

The “some” referred to in the statement above are international students who are considered “residents for tax purposes.” You are one if you can hold a Green Card or if you pass the Substantial Presence test. International students who spend 31 days in the US during the current year and 183 days during the three-year period — that includes the current year and the two years immediately before that — are considered as “residents for tax purposes,” according to Sprintax. Sprintax offers tax prep solution for international students, scholars and non-resident professionals.

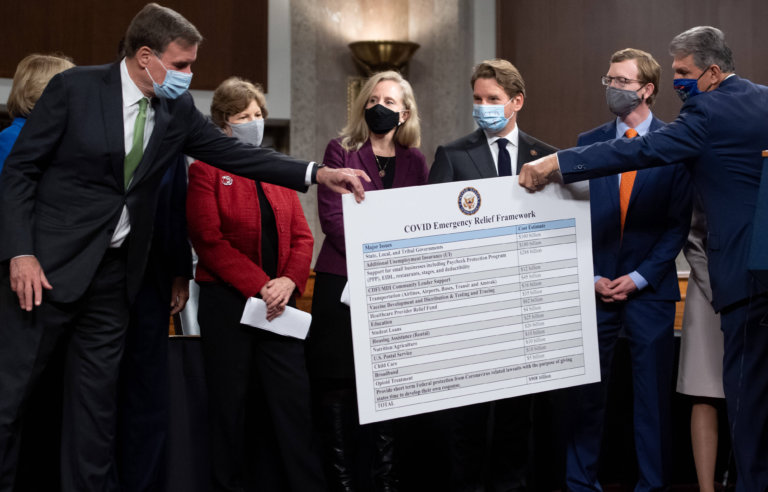

International students may be eligible to claim the next stimulus check if they meet certain requirements. Source: Al Bello/Getty Images/AFP

The law considers age and taxpayer status, not college enrollment status. “Taxpayers qualify for the Economic Impact Payment (EIP), both the old one and presumably the ‘next’ one, by simply being a taxpayer,” explained Mark Steber, chief tax officer for Jackson Hewitt Tax Services, as reported by CNBC.

Other groups who are not eligible for this payment are: individuals who can be claimed as a dependent by another taxpayer; an estate or trust; or married couples where one partner has an SSN and the other has an ITIN or no number.

International students who are not part of these groups and fulfill the criteria above check all the boxes to claim the next stimulus check. It’s not too late to claim the first round of stimulus money too, worth up to US$1,200 per individual. “They can get the stimulus payment they are eligible for in the form of a Recovery Rebate Credit when they file their 2020 taxes, as long as their parents don’t claim them as a dependent,” says Lisa Greene-Lewis, certified public accountant and TurboTax expert. This could increase the value of your tax refund or lower the amount of tax you need to pay. According to the IRS, you can claim the Recovery Rebate Credit on their 2020 Form 1040 or 1040-SR.

However, Iowa State University’s website states F-1 and J-1 visa holders are considered non-resident for tax purposes and thus not eligible for the US$1,200 payment. “If you filed your taxes as a resident by mistake, you will need to file an amended tax return prior to July 15, 2020, to correct your prior year tax return(s).