The UK is an education stronghold that attracts thousands of international students each year.

However, being a bastion for education can also mean paying a premium price for your education, on top of your living expenses. For instance, international students in the UK pay considerably more for their tuition compared to domestic students.

While UK higher education is highly valued by students, it’s worth thinking about how you can stretch your finances before you start, avoiding common money mistakes like falling prey to scams and losing money to unscrupulous individuals.

To save yourself the financial hardship and emotional turmoil that comes with financial woes, preparation helps. Here’s some advice to help you manage your finances:

Be aware of scams

Scams, including student visa and student housing scams, are rife, making it crucial for students to be ‘scam-aware’ and read up on the common modus operandi used by unscrupulous individuals to avoid falling prey to their devious schemes.

For instance, fraudulent visa agents often lure students with the promise of getting a student visa so they can work, but they generally tend to work more hours than legally allowed. Others may guarantee admission into a particular university before students have even applied.

Hence, it’s crucial for prospective international students in the UK to understand that there are no shortcuts to getting a job in the country without attending classes. Meanwhile, institutions don’t accept students without first receiving an application or any documents from you. Always check the information provided on websites against official sites, such as gov.uk and/or the university’s official website.

Meanwhile, students also need to keep an eye out for fraudulent landlords who require students to transfer money as a ‘holding deposit’ without visiting a property. The National Union of Students recommends that students make a payment via credit card in person at a trusted letting agents’ office, adding that a formal contract should be signed before any money changes hands.

Alternatively, you can ask your students’ union or accommodation office if they have approved lists of landlords or letting agents.

Keep track of exchange rates

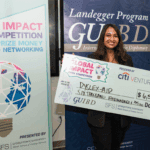

International students in the UK should monitor exchange rates. Source: Shutterstock

Are you coming from a country with a weaker currency than the UK? Your spending power may be considerably less, which makes it crucial that you keep track of foreign exchange rates before making certain purchases that require a significant amount of money.

We know – exchange rates fluctuate daily, but what can appear to be a minor change can matter greatly when you’re making large transactions (like paying your tuition fees for the semester), which could set you back by hundreds of dollars when done at the wrong time, depending on the type of money transfer service used.

Make a budget – and stick to it

Future-proofing your finances probably won’t be top on your list of priorities as a student, but failing to stick to a budget as a student can severely impact your lifestyle, not just during the semester, but also post-graduation.

To ensure your money stretches across the academic year, make a budget – and stick to it! This includes deducting how much you need for your monthly essentials (i.e. rent, school materials or fees, etc.) and living within your means, cutting back where necessary.

Liked this? Then you’ll love…

What to do if you’ve been scammed as an international student

Financial mistakes university students need to avoid at all costs