When Bastian Krieghoff was in China for an internship during his university days, he could not fill a single form by himself.

Everything was in Chinese, and Krieghoff, who is German-born and raised, wasn’t about to become fluent in one of the toughest languages in the world overnight.

“I knew how to say hello, and I knew how to order some food and stuff, but I was not able to do all these things written in Chinese,” says Krieghoff.

Luckily for him, the company he had been interning with paired him with a Chinese colleague to help him out. Back then, this involved informing the local police station of his accommodation and signing forms that he didn’t know the content of.

“Maybe I bought a washing machine in China, I wouldn’t know. I just knew that I needed to sign the document,” laughs Krieghoff, “It worked out in the end – I wasn’t arrested and was allowed to leave the country, but that was a really tough time.”

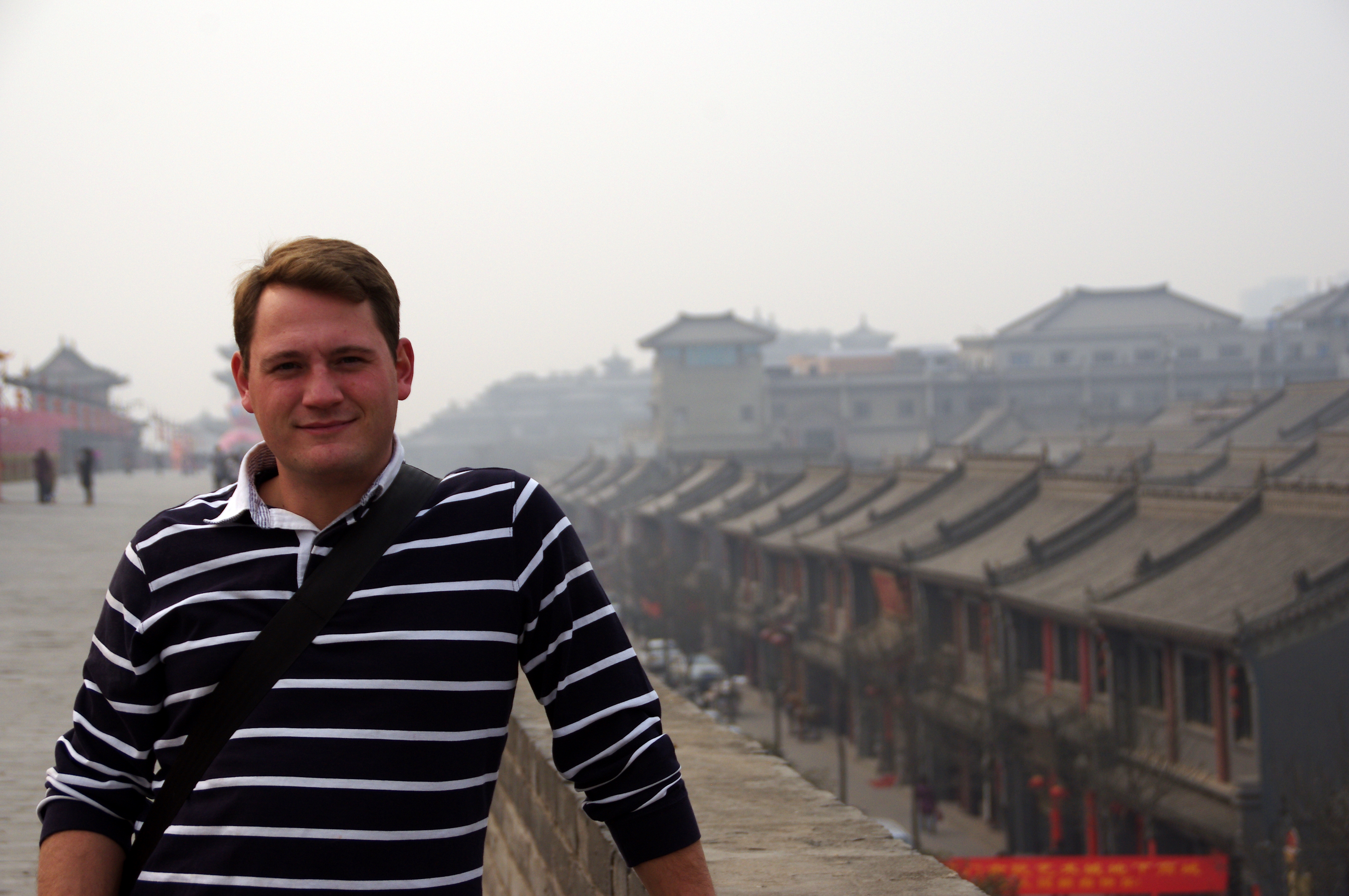

Before launching an app that helps international students in Germany, Krieghoff was interning in China as part of his university programme. This was when he first dealt with bureaucratic forms that all international students face. Source: Bastian Krieghoff

Fortunately for today’s international students, globalisation and technological advancements have improved tremendously over the past few decades.

While there are still some universal struggles that come with moving to a foreign country to pursue your studies, at least there are now more solutions available to help.

Like Fintiba, for example.

The key to creating a helpful business

“If you want to be a successful entrepreneur, you need to solve a problem.”

This was the piece of advice that pushed Krieghoff to launch Fintiba, a finance and insurance platform for international students settling in Germany. It goes a little beyond that too – they offer digital solutions with personal service to anyone who wants to work or study in the country.

For Krieghoff, joining this particular industry made sense. He’s worked with Commerzbank, one of the oldest banks in Germany, for years – even temporarily moving to Singapore and Switzerland to complete certain projects.

Crossing the border to Singapore was much easier than crossing the border to Switzerland, but Krieghoff worked it out in the end. Source: Bastian Krieghoff

He’s handled various projects, including regulatory, product implementation, and strategy.

Krieghoff’s biggest achievement then was being responsible for digitising German private bank Hauck & Aufhäuser’s private client unit, which sparked his idea of building his own business.

Cue the aforementioned advice.

“So if you’re not solving a problem, why should customers come to you?” says Krieghoff. “Why should they buy your products? Why should they sell?”

“I never wanted to build a company which is, for example, venture capital funded or burning money like other big players. I wanted to build a business which has an impact on the lives of people – a positive one.”

From there, it was a matter of figuring out what problem to solve, and the answer was simple — something that Krieghoff had already experienced repeatedly: bureaucracy.

“Germany is bureaucratic, and in my life, crossing borders was one of the tougher things to do,” he says.

“Then one day, a professor at a university with many international students coming to Germany told me to look at blocked accounts because those were really a mess back then.”

Blocked accounts are special accounts often required for a German student visa application. They are also a precondition for a residence permit in Germany as a way to show proof of financial resources.

Before Fintiba and other similar services, the process of opening a blocked account was complicated.

Deutsche Bank, a German multinational investment bank and financial services company, was the only bank that offered such services, primarily because they had branches worldwide.

International students would have had to download roughly 30 pages of a PDF, fill them without any guidance, travel to the Deutsche Bank branch abroad, identify themselves, have the forms stamped, and personally mail it to the bank’s headquarters in Hamburg.

If a mistake was made within the forms, you’d have to start all over again, as well as pay around 150 euros for the service.

Ultimately, people waited a year or more just to secure their blocked accounts.

“I thought, okay, we can do better than that,” says Krieghoff.

It was a stroke of luck that some important regulatory changes came during this time – most notably, international students could now open an account via video legitimation instead of physically getting verified at a bank’s branch.

With this new regulation in place and finding a partner bank to work with, Fintiba entered the market in 2017.

Their most significant promise to their customers? You can open a blocked account in six days instead of six months. In fact, six days was a generous timeline — it only takes less than 10 minutes to get yourself set up.

Better yet, Fintiba didn’t stop at just offering blocked accounts.

Fintiba’s founding team didn’t have any Germans, though everyone had studied abroad at one point or another. Source: Bastian Krieghoff

Helping international students in Germany one step at a time

It’s hard enough to move abroad to a new country and figure out life there, but international students in Germany have it a little rougher.

Aside from figuring out the varied insurance and securing a SIM card, you’ll also have to ensure you’re paying the monthly radio tax, even if you don’t have TV, radio, or internet access.

And if you want to really integrate into the community, you’ll need to be formally registered with the union, club, or association, otherwise known as “verein” in German.

In Krieghoff’s words, “It’s just Germany being Germany.”

But Fintiba is up to this challenge.

“There are several topics which are really, really complicated for international students in Germany, and this is where we thought, ‘Okay, we can help.’,” he says.

“In our app, we implemented advice for these topics and set up a system where we’ve filled in the necessary forms for you by using the data you’ve put in when creating an account.”

Krieghoff admits that it took him a year to understand the ins and outs of insurance in Germany despite being German banker.

Now, any student from around the world can find the information they need about navigating the intricacies and complexities of studying abroad in Germany.

Fintiba will send you a SIM card before your flight to Germany, direct you to their partners to help you figure out your German language courses to give you a head start in your learning, and even give you a hand with your visa application process via their Visa Tool. There’s also Companion, a digital checklist that enables you to track all the things you need to know and do before, during and after your move to Germany.

The best part? Much of it is free after you register with Fintiba, and there’s more to come.

The Fintiba team is made up of 22 nationalities, and each individual does their part to help other international students in Germany figure their way out and about the country. Source: Bastian Krieghoff

What it takes to make a service catering to international students

How is Fintiba nailing what international students in Germany need, want, or need clarification about?

Simple market research can take you far, but for a platform that doesn’t charge its users, Fintiba goes above and beyond.

While Krieghoff is bringing in his own experiences with being abroad, he’s got a team of talent from 22 nationalities ready to keep the platform up to date with the latest market needs.

In fact, more than a handful of Fintiba’s current employees once started as users of the platform, writing in to enquire about student jobs and internships before landing a full-time position in the company.

“It’s not important which team they end up with. If you look at marketing, product development, or customer service, most of our employees have been on this journey before, so they know the pains and problems of our customers, which really gives you another perspective on doing this,” says Krieghoff.

Fintiba’s digital checklist, Companion, had six people working on it, and almost everyone was once an international student.

“I think it’s the core of Fintiba, or in our DNA, to work like this. Being able to understand how this uncertainty feels for people going abroad, especially when you’re young, is a really huge thing.”

Evidently, what started as a simple solution to one problem has become the one-stop shop for all the information international students in Germany.

The services couldn’t have come at a better time, either, especially since Germany is seeing a record high in international student intake.

There were roughly 370,000 international students in Germany in the 2022/23 academic year, with 93,000 starting their first year of studies at German higher education institutions in the 2023/24 winter semester.

Fintiba’s first service – the blocked accounts – has already supported more than 300,000 students from nearly 200 countries since its inception, and the numbers are predicted to rise.

That’s not even considering the students who use Fintiba to get some advice on living in Germany.

“We want to extend the services we’re offering, and we want to tailor it even better,” says Krieghoff. “The Companion is a great tool, but we want to integrate it in a much deeper way so that we really help with the specific needs of international students in Germany.”

So, rest assured, if you’re confused about your upcoming educational journey to Germany, Fintiba is ready to help.